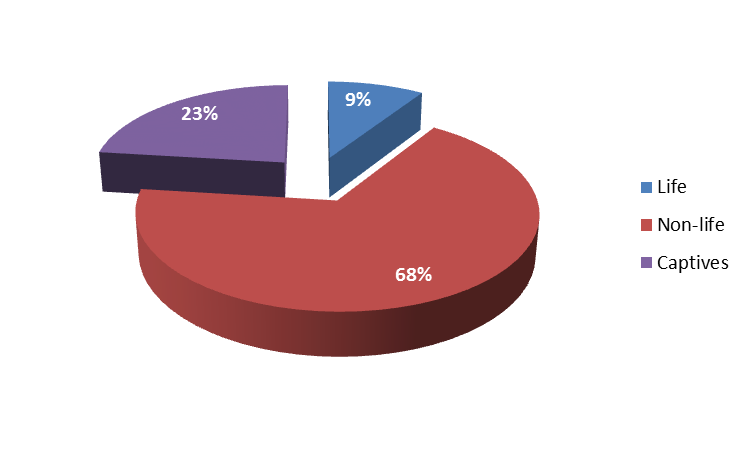

At the beginning of 2012, Gibraltar boasted 65 insurance entities, the main component being non-life insurers.

According to the most recent financial information available (2010), Gibraltar’s insurers were writing £2.5bn of Gross Premiums, with assets held of some £6.4bn.

Hidden in these figures are some 40 cells active in Protected cell Companies, meaning Gibraltar has well over 100 insurance company clients, in addition to 28 insurance intermediaries and 7 insurance managers.

Hidden in these figures are some 40 cells active in Protected cell Companies, meaning Gibraltar has well over 100 insurance company clients, in addition to 28 insurance intermediaries and 7 insurance managers.

Gibraltar now accounts for some 10% of the UK motor insurance market, a bigger percentage than Lloyd’s of London, traditionally a major player in that area.

So how has Gibraltar grown over the years, and what has driven this success story?

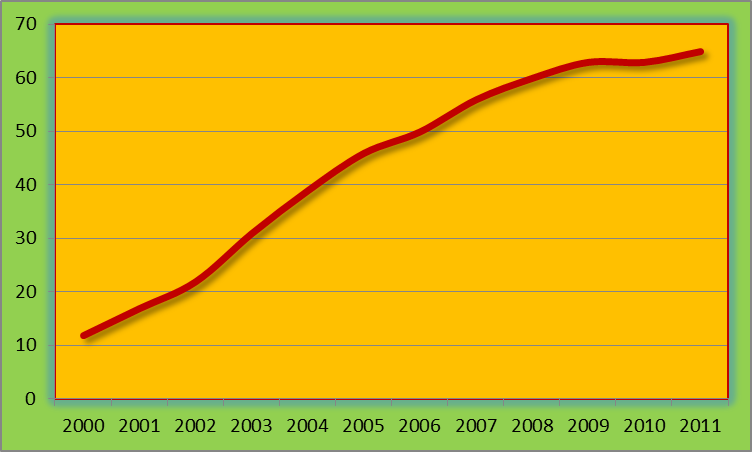

In the very early part of the 21st century, Gibraltar had not yet established itself on the European scene, and insurance companies numbered only around a dozen. However the hardening market in 2001 and the passing of Gibraltar’s own Protected Cell Companies Act in the same year sparked off interest in Gibraltar, which the practitioners on the Rock at the time, who had been working hard to gain name awareness for Gib, were able to convert to hard business.

Over the next few years, the rate of entry of insurers into Gibraltar was rapid and, whilst the initial flood has slowed to a steady trickle, the domicile is still growing, driven by a number of factors.

The European Key

The key to Gibraltar’s success has undoubtedly been opening the doorway to the European Single Market for Insurance. Gibraltar is part of the EU by dint of being a dependent territory of the United Kingdom, with derogations only from the common customs tariff, VAT rules and the Common Agricultural Policy (there being no agriculture on the Rock). In everything else Gibraltar is obliged to transpose all EU Directives, and those relating to insurance were no exception, giving rise to a great opportunity for the insurance sector.

By 1998, Gibraltar had enacted all the necessary European Directives and had put in place a regulatory framework that had allowed the UK Foreign and Commonwealth Office to declare that Gibraltar’s regulatory body was a “competent authority” within Europe, and therefore able to license insurance operators to passport into the rest of the European Economic Area.

This means that an insurance company which has its head office in Gibraltar, and is licensed by the Gibraltar Financial Services Commission, can insure risks in another EEA territory (the “host state”), without the need to apply for a licence in that territory.

The insurer can do this under the EU concept of either Freedom of Establishment or Freedom of Services.

Establishment provides that an insurer may establish a branch in the host state where it wishes to write business. The branch is fully responsible for transacting the business which the insurer underwrites, would have sufficient infrastructure of its own to do so and would pay taxes on the profits derived from that business.

Under Services, the insurer simply underwrites the risk cross-border, either dealing direct with the customer or via an intermediary in the host state. He may employ third party firms for administration and claims handling, especially if volumes of individual customers is expected to be high, and he will be taxed in the home state i.e. Gibraltar.

But why would the investors in an insurance company want to set up in Gibraltar, as opposed to elsewhere? There are a few reasons.

The Regulatory Advantage

Gibraltar’s Financial Services Commission (FSC) was established on 16 January 1991, in response to an ever more demanding supervisory world. Since then it has played a substantial and vital part in the development of the Rock’s insurance industry.

In other EU territories, regulatory bodies are faced with a large number of regulated entities and have to consider carefully how to apply their resource to supervise those entities in the most efficient way possible. This often leads to a formulaic approach to the regulatory process, especially the assessment of capital levels and the application of rules.

Gibraltar’s FSC is no exception in that it has to ensure its regulatory processes are efficient and that levels of capital within insurers are sufficient to meet EU minima at the very least, and usually higher to reflect the risk presented by each enterprise. However, working in a much smaller market enables the FSC’s approach to be much more accessible and its application of the same rules more tailor-made for the circumstances of each licensee.

Gibraltar insurers find that it is much easier for them to have a dialogue with the FSC than it would be with their counterpart in one of the main European territories, and the FSC is keen to maintain contact at a practical level with its licensees, with application of risk measurement techniques and a planned programme of onsite visits. This accessibility and availability to discuss matters rather than the formulaic application of rules have meant Gibraltar is perceived as a business-friendly domicile, without diluting the consumer protection embodied in a firm regulatory regime.

The new regulatory regime of Solvency II will have a frictional cost impact on Gibraltar insurers, as in all European territories, however the FSC is in the process of boosting its resources to handle the increased complexity of regulation and the principles of regulatory dialogue and accessibility will remain one of Gibraltar’s differentiating features.

The T Word

For the first few years of its growth as an insurance domicile, Gibraltar had the benefit of potentially a zero tax rate. This was surprisingly not that much of a driver for a number of corporate investors, who would in any case be taxed under increasingly sophisticated Controlled Foreign Corporation tax nets, but there were some who were able to derive a tax advantage. In recent years, EU and OECD tax philosophy has focused on the “harmful tax competition” supposedly represented by territories having zero rate schemes, and Gibraltar consequently passed in 2010 an all-new income Tax Act, under which the headline rate of tax is now 10%. This is still competitive with a number of European domiciles and the effective rate can be even lower with the application of tax breaks such as exemption of investment income, which are available specifically to insurance companies.

Gibraltar is therefore now a “low tax rate” environment, as opposed to a tax free zone, which is in keeping with its positioning as a mainstream, reputable onshore domicile.

We’re here to help

One of the things most visitors first notice on coming to Gibraltar (apart from the fact that a road crosses the airport runway) is the can-do attitude espoused by the business classes there. Gibraltar has been a finance centre for over 40 years, has repositioned itself to fit in with an ever-changing regulatory and compliance world, and is home to a number of business professionals who are ideally suited to provide services to insurance entities.

As the insurance sector has grown, insurance managers and companies have built up a pool of trained and experienced staff, and the industry organisations such as the Gibraltar Insurance Association and latterly the Gibraltar Insurance Institute have played a significant role in educating the wider infrastructure of lawyers, accountants and other professionals about what is needed to nurture and grow the industry in Gibraltar.

Telecommunications have benefited from the demands of the gaming sector, and insurance reaps the benefit, along with other technology support and support services.

What Else?

Gibraltar has its own statutes and legal system, based on the familiar system of English law. It is a Sterling territory (currency is GBP); the official language is English, though many employees are bi-lingual in English and Spanish. It has easy access from UK and other European centres, with a recently built airport signalling its Government’s intention to attract flights from all around Europe, and a land border with the European mainland.

And after school?

When the working day is done, it’s nice to know relaxation is at hand, and with premier golf courses, excellent restaurants and five star hotels all within easy reach, plus 300 days of sunshine a year, could there be a better place to domicile an insurance operation than Gibraltar?

1000

YuanName:

Mobile Number:

Comments…

After your successful submission, our staff will soon be in touch.