Investors in Indonesia's burgeoning insurance industry have in the past set their sights primarily on the life insurance business, and while that market segment continues to hold a lot of potential, non-life insurance services are getting increased attention. The general insurance industry is still small in Indonesia and characterized by low rates of market penetration. By comparison with neighbouring countries, Indonesians enjoy little insurance coverage, but as the economy matures, both individuals and businesses will demand protection for increasing assets and against a wider range of risks.

Increasing capital needs are one reason for high M&A activity in the industry and provide a strong incentive for local insurers to bolster their financial foundation with the help of global insurance firms or local banks.

Indonesia's insurance sector has long been open to foreign investment, and while there are calls to restrict engagement by global players, there is no overlooking the fact that the industry needs more funds to meet elevated capital requirements. As local companies get in shape for regional competition in the upcoming ASEAN Economic Community (AEC), the industry is expected to see further consolidation. All of this should open doors for mergers and acquisitions and for foreign firms to enter the market.

A small market with big potential

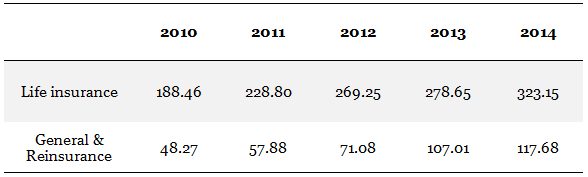

Over the last five years (2010-2014), Indonesia's insurance industry has grown at an average annual rate of 19% in terms of assets and 20% in terms of premiums, according to the country's Financial Services Authority (OJK). Total assets reached 755 trillion IDR at the end of 2014, which included life insurance assets of 323 trillion IDR, general insurance assets of 108 trillion IDR and reinsurance assets amounting to 9 trillion IDR. Premiums rose by 47% in 2014 to a total of 271 trillion IDR at the end of the year (this steep rise can be attributed to the introduction of BPJS), which included life insurance premiums of 130 trillion IDR and general insurance premiums of 55 trillion IDR; reinsurers contributed around 6 trillion IDR in premiums. Premiums in both the life and non-life segment have grown at double-digit annual rates over the past years, but the non-life segment saw faster growth than life insurance in 2014, with premiums rising by 18%, just slightly down from 20% the year before.

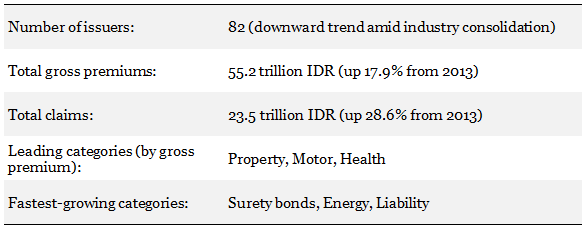

Meanwhile, market penetration for insurance services remains low overall, and particularly so for non-life insurance. Measured as total premiums in relation to GDP, the insurance industry showed a penetration rate of merely 2.1% in 2014, far below the rate of fellow ASEAN countries Malaysia (4.9%) and Thailand (4.7%), according to the OJK. At the end of 2014, the OJK had registered 52 life insurance companies, 82 general insurance companies and 5 providers of reinsurance. The market is fairly concentrated, with the top ten players commanding more than half of the total assets.

Indonesia Insurance Industry Assets (trillion IDR)

Source: OJK

Indonesia General Insurance Snapshot 2014

Sources: OJK; AAUI

Global firms keen to enter

Joint ventures with local companies is the typical way for foreign insurers to engage in Indonesia. In the general insurance market, major global names include ACE (which controls ACE Jaya Proteksi), Allianz (PT Asuransi Allianz Utama Indonesia), American International Group (PT AIG Insurance Indonesia), Axa (PT Asuransi AXA Indonesia), Mitsui Sumitomo Insurance Company (PT Asuransi MSIG Indonesia), Fairfax Financial Holdings (PT Fairfax Insurance Indonesia) and Zurich Insurance Group (PT Zurich Insurance Indonesia).

According to media reports, more insurers from Europe and the US are looking to enter the Indonesian market through acquisitions in 2015, while investors from other Asian countries are gearing up their engagement as well. Foreign-controlled joint ventures in general insurance face strong competition from long-established local firms which include players such as Panin Insurance, Asuransi Sinar Mas and state-owned Asuransi Jasa Indonesia. Local banks are showing a keen interest to buy into the industry or expand their existing insurance business.

A sector quite open to foreign investment

Foreign insurers are barred from opening sales branches in Indonesia, but the current law allows them to own up to 80% of local insurance companies, be it through acquisition or incorporation. This is relatively high compared to other economic activities and also higher than in most other emerging economies, including Malaysia and Thailand. There have been demands to lower the foreign ownership cap, but contrary to previous concerns, the 80% cap was maintained in Law No. 40 of 2014 on Insurance, which in October 2014 superseded the 1992 insurance law.

The minimal capital required for insurance companies to operate in Indonesia has been raised over the years, with 100 billion IDR demanded of general insurers since the beginning of 2015. The bar is expected to be raised further in the next few years. Increasing capital needs are one reason for high M&A activity in the industry and provide a strong incentive for local insurers to bolster their financial foundation with the help of global insurance firms or local banks.

Property and casualty insurance to gain more attention

Accounting for around two thirds of total insurance premiums in Indonesia, life insurance still dwarfs all other segments of the industry. As the economy matures, however, the focus can be expected to shift towards property and casualty insurance. And while motor insurance traditionally dominated this segment, car ownership is not growing as fast as it used to. In fact, nationwide car sales dropped slightly in 2014, and the Indonesian Automotive Manufacturers Association (Gaikindo) predicted a further decline in 2015. Also, a highly competitive environment is putting pressure on profitability in the motor insurance segment, making it hard for new players to enter. The health insurance segment, meanwhile, is facing competition from the new national insurance scheme. While this won't spoil the market for private players in the near future (See Health Insurance in Indonesia: Public Coverage No Threat to Private Sector), it does present an element of long-term uncertainty. For these reasons, other products are moving to the centre of attention within the general insurance industry, such as policies for home owners and public infrastructure.

Both the residential property market (See Residential Property: Indonesian Market Remains Attractive Despite Slowdown) and public infrastructure (See Indonesian Infrastructure: Tremendous PPP Opportunities) have plenty of potential for future growth, which should generate demand for related insurance and underwriting services, such as property insurance, engineering insurance or surety bonds to mitigate procurement and contracting risks. In fact, surety bonds showed the fastest increase of all general insurance categories analysed by the Indonesian General Insurance Association (AAUI), with total gross premiums growing by 105% to 2 trillion IDR in 2014. Property insurance, meanwhile, overtook motor insurance to become the biggest segment in general insurance with gross premiums amounting to 16.1 trillion IDR in 2014, up 27% from the preceding year.

Aside from the public and private construction business, the transportation sector is another major growth market for insurance. Maritime and aviation insurance, insurance of cargo in transit and related liability coverage should all see rising demand as national and international freight volumes rise. A major driver of this growth is the fast economic development of regional capitals across Indonesia.

Sharia-compliant insurance policies (takaful), while a niche product in Indonesia's overall insurance industry, have been booming in recent years. The takaful industry is poised for rapid expansion globally, but in Indonesia, despite the country's predominantly Muslim population, its market penetration remains low and the industry is under-developed when compared to neighbouring Malaysia. The government appears committed to change this, with the new Insurance Law demanding that insurance companies spin off their takaful business to create full-fledged Islamic insurance companies. Currently, most sharia-compliant policies are sold as special products by large insurers, who generate most of their revenue from the conventional business. To exist as individual companies, takaful units need to boost their capital, which again offers opportunities for new entrants to get into the market. Shariah-compliant insurance – which accounted for 3.9% of total insurance assets at the end of 2014 – is expected to grow faster than conventional insurance over the coming years.

Outlook

Thanks to its large and young population with increasing affluence, robust economic growth and relatively permissive foreign investment laws, Indonesia will continue to be one of the most coveted markets for the global insurance industry. Short-term capital outflows as a result of monetary tightening in advanced economies will not spoil the country's long-term appeal. The new Insurance Law has improved regulatory clarity and should yield new business opportunities in the takaful segment. Going into the regions with scaled-down products for individuals and small enterprises promises to unlock new demand among tens of millions of Indonesians who at present enjoy little or no insurance coverage. Drawing up easy-to-understand policies and educating people on the benefits of insurance will be a major part of this task.

0

YuanName:

Mobile Number:

Comments…

After your successful submission, our staff will soon be in touch.