London has again come out at the top of the twice-annual Global Financial Centres Index, which ranks the world’s leading financial centres, but those who compile the index suggest that there are likely to be changes down the road as a result of Brexit.

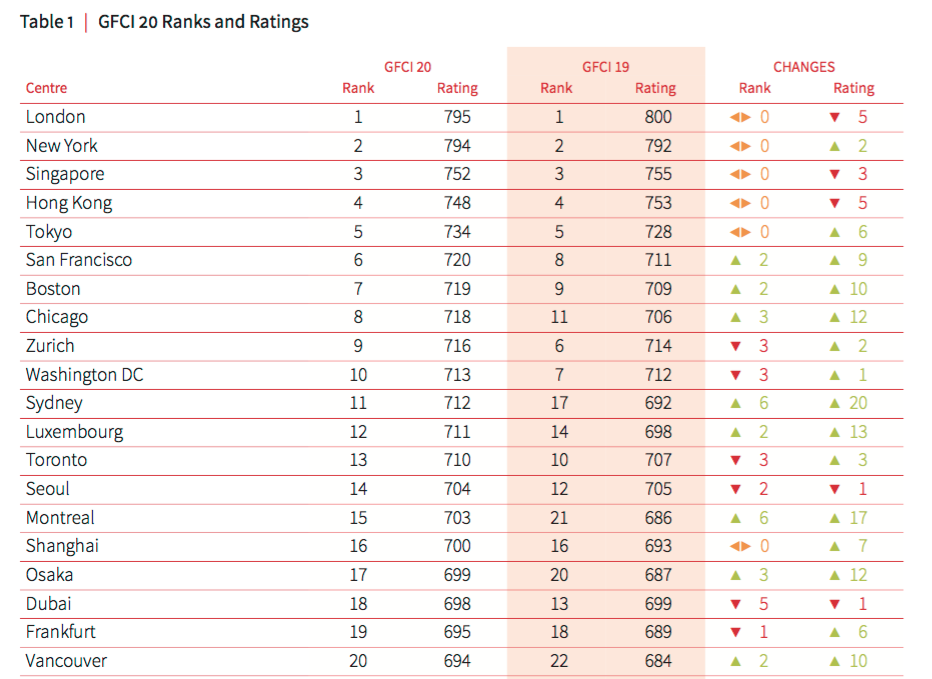

The latest index, which is based on responses from more than 2,400 financial services industry executives collected in the 24 months to the end of June and which was released today, showed that New York remained in second place, with Singapore, Hong Kong and Tokyo in third, fourth, fifth and sixth places respectively, as they were in April, when the previous GFCI ranking was published.

However, today’s ranking also shows London’s lead over New York has been narrowed to just one point, compared with 8 points in April, while its lead over Singapore has narrowed to 42 points from 45.

Noting that it was too soon for the “Leave” result of the UK’s 24 June referendum on whether to remain in Europe to be fully reflected in today’s GFCI ranking, the GFCI authors suggested that their next edition, due to come out in March, is likely to show some significant changes, based on the post-referendum assessments they have been receiving.

The GFCI is published by the London-based Z/Yen research organisation, in conjunction with the China Development Institute (CDI).

North America rise

Elsewhere, all North American centres except Calgary moved up in the ratings. Calgary focuses on energy finance and the recent volatility in oil prices is likely to have caused a decline in Calgary’s rating. San Francisco and Boston are second and third in North America – reflecting the growing importance of Fintech. Chicago re-enters the GFCI top ten and Toronto, the leading Canadian centre, is now 13th having been eighth a year ago.

Western Europe remains a region in flux. Luxembourg and Dublin show strong rises in the ratings whilst Geneva and Amsterdam fall. Early indications following the Brexit referendum result are that decision-makers are looking around and considering Luxembourg and Dublin as potential locations if they need to leave the UK, the GFCI said. While wealth management in Geneva may be suffering from increased transparency requirements of international regulators.

Offshore financial centres

Offshore financial centres are recovering lost ground with Jersey, Guernsey, the Isle of Man, the Cayman Islands, Bermuda, the British Virgin Islands, all up in the GFCI 20 ratings.

Middle Eastern centres however are in a decline, the research showed With the exception of Bahrain which saw a modest rise, all Middle Eastern centres were somewhat down, although Dubai only fell by a single point, remaining well ahead of other centres in the region.

The think tanks that compile the data include Z/Yen Group in London and the China Development Institute in Shenzhen and both jointly launched GFCI 18 in Shenzhen 2015. And in July 2016 they have established a new strategic partnership for research into financial centres.

“The GFCI shows that London, New York, Singapore and Hong Kong have maintained their strong positions as the four leading global financial centres,” said Professor Fan Gang, president, China Development Institute.

‘Compete and collaborate’

“They compete and collaborate with each other. As the power of global financial markets is shifting from North America and Europe to Asia, the financial centres on the Chinese mainland are rapidly rising in importance with five cities included in the GFCI top fifty,” said Professor Fan Gang.

The top 20 of GFCI 20 ranks and ratings are shown below:global financial centres top 20

Elsewhere some Eastern European and Central Asian centres prosper whilst others struggle. Warsaw, Tallinn and Riga are now the leaders in this region. Istanbul, Moscow, St Petersburg and Athens continue to languish.

Australasian centres are doing well. Three of the top five global centres are Asian. Hong Kong and Singapore had some small declines. Sydney and Melbourne both saw solid increases in their ratings.

Sao Paulo, Rio de Janeiro and Mexico continue to struggle. Sao Paulo remains the top Latin American centre in GFCI 20, despite falling eight places. Trinidad and Tobago has entered the index for the first time in 71st place.

Low volatility

GFCI ratings volatility remains low. Overall, 39 centres rose in the ranks whilst 41 went down and six remained in the same place. 15 of top 20 centres see a rise in their ratings whilst 14 of the bottom 20 centres decreased in the ratings. This represents a widening of the ‘spread’ of ratings with the leading centres becoming stronger whilst the lesser centres continue to struggle.

Shanghai, Shenzhen and Beijing rank as the top three financial centres on the Chinese mainland. The three have their own merits and play a complementary role to each other. Shanghai, the birthplace of China’s modern finance industry, has stepped up its efforts to transform itself into a major international financial centre since 2009.

The GFCI provides ratings, rankings and profiles for financial centres, drawing on two separate sources of data – instrumental factors and responses to an online survey. The GFCI was created in 2005 and first published by Z/Yen Group in March 2007.

The GFCI is updated and republished each September and March. This is the twentieth edition (GFCI 20). 103 financial centres are actively researched. 87 financial centres appear in GFCI 20. For the full data release and list click here. The remaining 16 ‘associate centres’ will join the index when they receive sufficient assessments.

Source:International Investment