In 2018 Labuan add 5 new captives, realize 2 years consecutive growing since 2016,becoming the fastest growing captive market in Asia-Pacific region.

In 2014-2015,there are 40 captives in Labuan. Labuan ended the decline situation from 2016(losing 1 captive),increasing 4 more captives at 2017. By the end of 2018,there are 48 captives in Labuan, ranking No. 2 in Asia-Pacific region, and get closer with the No.1 Singapore captive market.

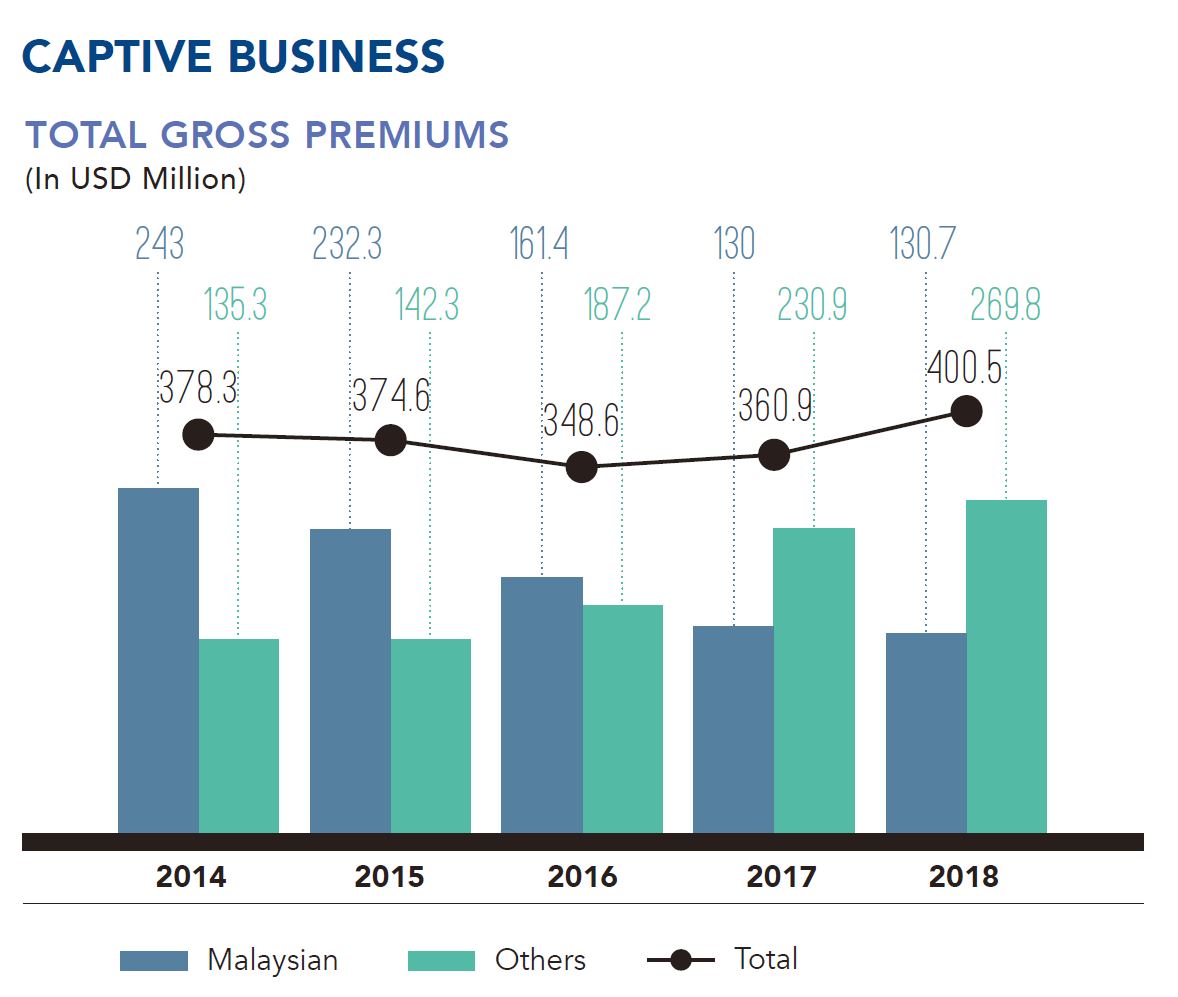

The captive insurance business continued its growth in 2018 for consecutively 5 years, with total gross premium up by 11% to USD400.5 million; with 67.4% of premiums from foreign business. Six new captives were set up in 2018, all of which were Asian based.

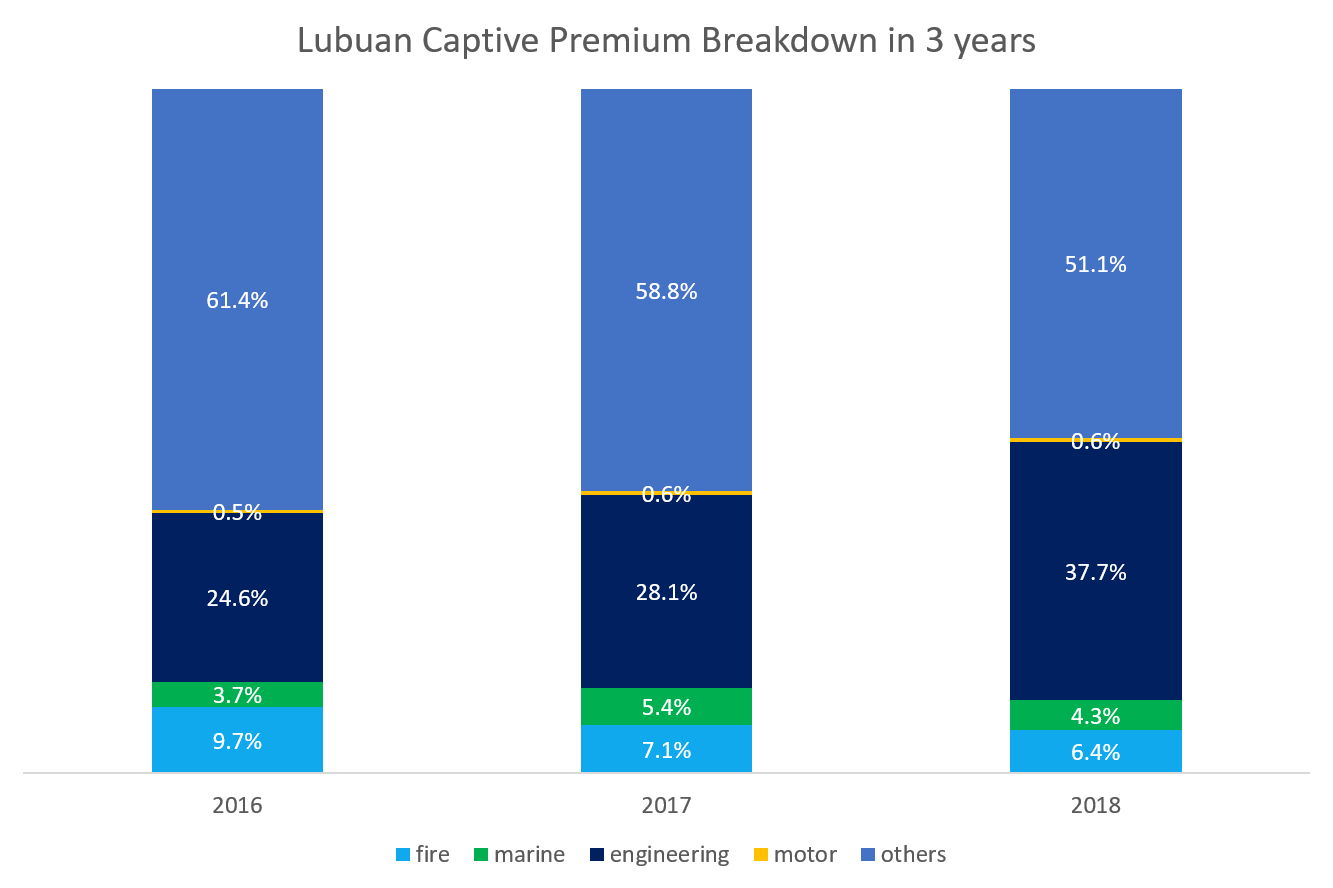

Breaking down of the captive premium, the captive mainly undertaking special risk insurance products. The special risk share up year on year. In 2018, except for the conventional fire, marine,engineering,motor insurance, the special risk's share is over 61%, far more than conventional business insurers in Labuan of 34%.

The rapid growth of Malaysia Labuan captive maket benefit from its flexible captive supervison policy and positive market promotion strategy.

The captive forms permitted by Labuan FSA including the mainstream capitve form wolrdwide, including Pure or single captives,Group or association captives, Protectedcell captives (PCC) and Multi owner captives. It provides access to the region and Malaysia’s strong direct insurance market,Captives in Labuan IBFC may obtain reinsurance cover from any reinsurance company,the captive insurance entities may also write third party risks provided and life insurance in parent group if it is approved by the regulator, Labuan Financial Services Authority (Labuan FSA).

Malaysia being the largest Takaful (re)insurance market worldwide make Lubuan another unique advantage. By the end of 2018, Labuan insurance sector remained strong with total gross written premiums posting a significant increase to USD1.7 billion, rising 19.1% from the previous year. Foreign insurance business accounted for 64.7% of the total premiums underwritten. 22 insurance and insurance-related entities were approved, comprising six captives, 13 brokers, two (re)insurers and one underwriting manager, bringing the total number of approved Labuan insurance and insurance-related entities to 216.

During 2017-2018 Lubuan IBFC promote capitve business positively, held several maketing seminar in China main land, HK and Singapore. Mar. 19th, 2019, the Lubuan FSA signed MOU with CBIRC in Beijing.

In 2018, for other Asia-Pacific captive market, the China mainland and HK have 8 captives after HK add 1 more captive. Though there is no more new captive setting up, Singapore keeps the No.1 captive domicile in Asian-Pacific region with total 71 captives.