2017/08/02

没有人知道比特币是否会获得广泛认可。但作为加密货币的底层技术,区块链技术可能会从根本上改变许多经济领域,并彻底变革金融业。

通过区块链技术,各类信息得以记录在防篡改的记录系统中。

比特币,2009年初全球计算机网络中引入的一种虚拟货币,其声誉好坏参半。它们不仅因其价值波动极大而臭名昭著,还被视为一种经常用来超越——也确实超越了——法律界限的支付方式。这种全新的货币系统的革新性在于其运作完全不受任何国家中央银行的控制,而且不需要诸如商业银行之类的集中交换实体。该系统本身决定了货币的防伪性,并确保货币流通总量不超过固定限额。然而,比起比特币本身,金融业和IT业对其底层区块链技术的兴趣要大得多。除了应用于比特币及众多与之类似的虚拟货币之外,区块链技术尚处于试验阶段,尽管其应用潜力远不止是虚拟货币交易。

比特币——包括区块链技术——是由一个化名为“中本聪”的人或团队创造的。中本聪于2008年出版的长达九页的概念说明中描述了一种专属P2P形式的电子货币。自此以后,一系列初创公司、银行和IT公司进一步推动了这一底层技术概念的发展。其目标在于将这一技术应用到其他商业领域,例如证券交易。此外,他们希望在区块链技术的帮助下开发新颖独特的合约形式。

去中心化的记账系统和加密技术

简单地说,区块链是一种采用数字化管理的去中心化公共账本,由全球各地许许多的计算机共同管理。正如其名称所示,区块链是系列或链式(数据)区块。就比特币而言,这些区块涵盖曾发生的所有交易。因此,随着后续发生的每次交易,这种块链将不断扩增。与银行转账不同,比特币支付方和接收方的身份采用化名形式。

替代性支付方式

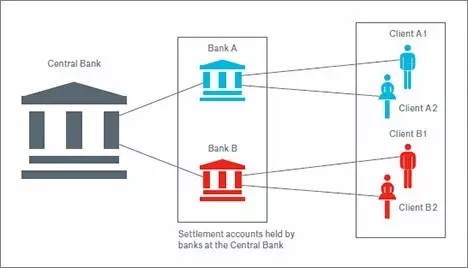

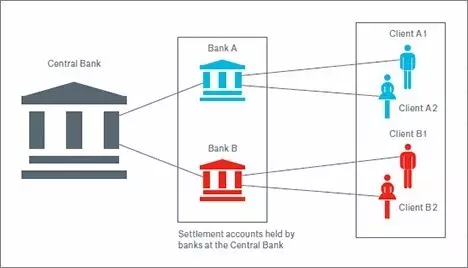

图1:A1在中心化支付系统中向B1付款

– 款项从客户A1在银行A的账户中扣除。

– 中央银行将款项从银行A的结算账户转至银行B的结算账户。

– 中央银行维护对银行间交易的集中记录(总账),验证交易并防止重复消费和假冒。

– 银行B将款项添加至客户B1的账户。

– 银行A和B各自维护其客户A1和B1的交易总账。

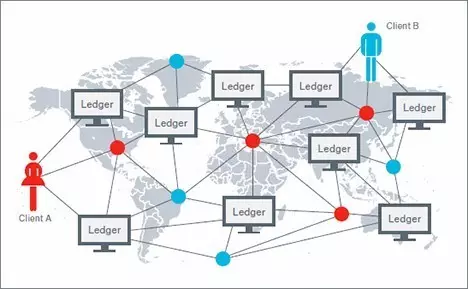

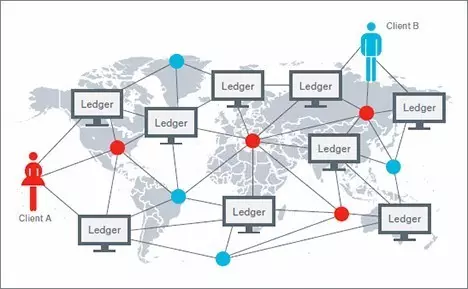

图2:A以替代性方式通过区块链向B付款

交易记录(总账)副本存储在网络中的多台计算机中,可供所有人查看。交易由具有计算能力的众多网络节点(数据挖掘组件)处理。数据挖掘组件在验证过程中解开密码。按照“工作证明”概念,它们必须向网络证明其已完成适用的工作步骤。此环节成本高昂(计算和能源资源)。通过设法使操弄在成本上完全无法实现,来确保该系统“值得信赖”。如果某个数据挖掘组件试图在系统中登记一项伪造的交易,其他数据挖掘组件将阻止该操作。

基于区块链和智能合约的风险转移

下一发展阶段将会是将区块链技术与“智能合约”理念相结合。智能合约理念最早可追溯到二十世纪九十年代初,被定义为一种基于计算机的合约条款自动执行协议。如果合约参与方企图违反协议,比如暂停支付汽车购买分期付款,智能合约可以自动锁闭车门或使点火开关无法使用。在网购领域,仅当货运方将商品交付给收货人并通过GPS验证地址正确之后才会自动付款。与区块链技术相结合之后,智能合约无需任何中间机构即可维护独立的合约权利。区块链提供了参与各方均可信赖且对其透明公开的平台,正是智能合约实现突破所需的媒介。在物联网(IoT)领域,区块链是使设备能够通过智能合约交换付款与服务所需的网络。致力于实现这一应用的相关工作也已经展开。

区块链还可以提高保险公司索赔处理流程的效率。比如说,通过应用程序申报的索赔能够清晰明确地记录在区块链中。索赔处理流程中的所有其他步骤都将以对保险公司和客户透明公开的方式安全地记录在区块链中。外部险损理算师、保险公司与其他各方之间将不再需要日常通信,因此索赔管理效率得以提高。在医疗保健领域,私人区块链可用来安全地保存和管理患者数据,有效避免操弄风险或未授权访问风险,并可现实医生、医院和健康保险公司等各类授权用户之间的信息交换。

区块链技术目前尚处于发展初期,由于缺乏高效的基础设施,其发展形势并不明朗。要实现这项技术的广泛应用,将需要一套全新的软件架构,但谁也说不准这可能需要多少成本。尽管如此,此技术已催生出其专属经济领域(虽然规模尚小),包括一整系列服务提供商。因此,如今的明智之举是审时度势,避免在金融系统发生变革之际猝不及防。然而,对于保险人来说,这是一个开发基于区块链的全新产品的机会,这些新产品将凭借其透明性和高效性,能够让人憧憬新的风险与市场。

Bitcoins, a virtual currency in a global network of computers introduced in early 2009, have a dubious reputation. Not only are they notorious for their extreme fluctuations in value, but they are also considered a form of payment frequently used to stretch – and indeed go beyond – the bounds of legality. What makes the new currency system revolutionary is that it operates entirely without any state control by a central bank and does not require central offices such as commercial banks. The system itself makes the currency forgery-proof and ensures that the amount of money in circulation does not exceed a fixed limit. However, the financial and IT industries are far more interested in the underlying blockchain technology than in the bitcoins themselves. Except for bitcoin and its numerous clones, the technology has not progressed beyond the experimental stage, despite its potential for far more than just virtual currency transactions.

Bitcoin – and hence blockchain – was created by a person or group of people known under the pseudonym Satoshi Nakamoto. The nine-page concept published by Satoshi Nakamoto in 2008 described an exclusively peer-to-peer version of electronic money. Since then, the underlying idea has been developed further by a whole series of start-ups, banks and IT companies. Their aim is to apply the technology to other fields of business, such as securities trading. In addition, they hope to develop innovative contractual forms with the aid of blockchain technology.

Decentralised accounting and cryptography

In very simple terms, a blockchain is a digitally managed public ledger that is decentralised and managed by a vast number of computers throughout the world. As the name implies, a blockchain is a series or chain of (data) blocks. In the case of bitcoin, these blocks contain all the transactions ever undertaken. The chain consequently grows with each subsequent transaction. Unlike bank transfers, the identities of the bitcoin sender and recipient are pseudonymised.

Since the ledger can be viewed by every user but ¬cannot be altered by any single individual, the information it contains is both transparent and to a large extent tamper-proof. New entries are governed by strict rules and require the general consent of the users – in other words, they can only be made when a corresponding consensus has been generated by the majority of the computing power in the system. Ideally, this would consist of thousands of cooperative users, against whom a lone scammer would not stand a chance. In bitcoin’s case, new blocks are generated by so-called miners. Aided by powerful computers, they calculate a cryptographic checksum for each block to confirm the transaction data. The first miner to calculate the correct checksum is rewarded with new bitcoins and the new checksum is disclosed to all users. Because checksums are difficult to calculate but easy to verify, a block and the transactions it ¬confirms cannot be altered once the block has been generated. This protects the blockchain against manipulation and cyber attacks. As bitcoin is based on cryptographic methods, it is known as a crypto¬currency.

Alternative ways of payment © Source: IMF

© Source: IMF

Fig. 1: Payment by A1 to B1 in a ¬centralised payment system

Money is deducted from Client A 1’s account at Bank A. The central bank moves money from Bank A’s settlement account to Bank B’s settlement account. The central bank maintains a central record (ledger) of interbank transactions, validating transactions and safeguarding against double-spending and counterfeiting. Bank B adds money to Client B 1’s account. Banks A and B maintain the ledger of transactions for their clients A 1 and B 1 respectively.

more

© Source: IMF

Fig. 2: Alternative flow of payments from A to B via a blockchain

Copies of transaction records (ledgers) are held on multiple computers in the network where they are visible to everyone. The transaction is processed by numerous network nodes (miners) which provide computing capacity. Miners solve a cryptographic puzzle as part of the validation process. According to the “proof of work” concept, they must prove to the network that they have completed the applicable work step. This is expensive (computing and energy resources). The “trustworthiness” of the system is ensured by making any attempts at manipulation prohibitively expensive. If a miner attempts to register a forged transaction in the system, it will be prevented from doing so by the others.

more

Because blockchain users as a whole ensure that the ledger is always up to date, there is no need for any further authorities to verify that it is correct. The users’ own interest in mining as many bitcoins as -possible makes this a secure system. It makes it impossible for a currency unit to be used for several transactions at the same time.

Blockchain technology is not only considered to be particularly secure, it is also cost-effective and fast. In bitcoin’s case, for instance, transactions are undertaken between the parties directly, without the otherwise necessary involvement of banks. Transactions naturally do not take place free of charge, for the data has to be processed and saved in the blockchain. However, the process would still be vastly more efficient than current forms of payment transactions, as intermediaries between the parties, i.e. banks, would not be needed.

Internet of Value based on blockchain technology

What makes this concept so interesting to other sectors of the economy is that every action is irrevocably documented in the system. Blockchains not only log currency transactions, they can basically also log any and every business transaction, making them an all-purpose tool for cases in which rights or claims need to be permanently documented or transferred to a new proprietor. The bitcoin blockchain already includes additional space for a payment reference for each transaction. This can be used to represent other assets.

Ownership of real estate or the authenticity of such assets as works of art or diamonds can be documented in this way, for example. Intermediaries and representatives such as lawyers, notaries and experts would play an increasingly minor role, usurped by cryptography, on the basis of which a tamper-proof record of all relevant information in the blockchain is created. Endeavours to bring this about are subsumed under the heading Internet of Value. Just as the World Wide Web has revolutionised the exchange of information, blockchain could place the exchange of value on a completely new footing. And as with the development of the internet, companies will progressively discover more and more applications for the blockchain. Some experts believe that the technology’s current potential is the same as that of the internet in the early 1990s. Dozens of start-ups are already investigating ways and means of using the blockchain.

Banks get in on the act

The simple fact that such central banks as the European Central Bank and the Bank of England, as well as regulatory authorities and the International Monetary Fund (IMF) are showing a growing interest in the subject proves that these trends must be taken seriously. The Euro Banking Association (EBA) has issued a recommendation to its members to investigate the potential of blockchains. Among the usage scenarios, the EBA lists currency trading, cross-border transactions, real-time bank transfers and the handling of more complex financial products.

It is likely that the banks will create their own blockchain networks, steering clear of bitcoin. Transactions will not only be quicker, but cheaper too, and we can expect to see the emergence of some innovative services. Instead of every bank keeping its own separate internal credit and debit accounts, the blockchain could be used as a universal ledger, lightening the load for all. The authenticity and correctness of transactions could be verified locally by the banks’ data centres. The arduous process of coordination between systems would no longer be necessary. According to the IMF, the international transfer of small amounts cost an average of 7.7% in fees in 2015; the charges for bitcoin transactions would amount to no more than around 1%.

Initial trials have already been launched by the financial industry. The US start-up R3 CEV, for instance, has gained the support of more than 40 banks worldwide to revise and improve the financial markets’ present ecosystem. The aim is to develop uniform protocols and standards for blockchain-based banking in order to revolutionise infrastructure in the financial sector. Together with a group of eleven banks, R3 CEV has already implemented a first trial. As a result, transactions can now be sent around the world in real time. While this was merely a simulation, further projects are likely to follow.

Disputes could be avoided when transferring -securities

The US technology exchange Nasdaq is also using the blockchain on an experimental basis and launched the Linq platform in late 2015. Its objective is to use the new technology to handle and document the trading in stocks of as-yet unlisted companies (private placements). The main advantage is that the interval between trading time and settlement of the securities transactions – which can amount to as much as three days for the majority of securities in the US – is reduced to seconds. This would eliminate disputes resulting from chronological discrepancy between conclusion of the contract and physical transfer (e.g. settlement and counterparty risks).

The absence of trustworthy land registers and land registry offices is a problem in many countries. Here too, blockchains could be used as a cost-effective and secure archive for property rights, open to inspection by anyone. Another possibility would be to set up electronic registers with which luxury goods and works of art could be unambiguously identified and ownership documented. This would render super¬fluous the easily forged certificates of authenticity currently used in the diamond trade. In a blockchain, every gem would be unambiguously identified by a certain number of characteristic features (such as size, weight, purity, colour and cut) and assigned to a particular owner. It could only be sold if the authenticity of the gem and the correctness of the transaction were jointly confirmed by all computers in the system. The underlying principle is always the same: a trustworthy register eliminates the need for intermediaries in a transaction, cutting costs and speeding up processing.

Risk transfer based on blockchains and smart -contracts

The next development stage will be to combine blockchain technology with the concept of “smart contracts”. Smart contracts were first defined in the early 1990s as a computer-based protocol for automatic execution of the terms of a contract. If a contractual partner were to breach an agreement, for instance by suspending payment of the purchase instalments for a car, the smart contract could automatically lock the vehicle doors or immobilise its ignition. In online shopping, an article would be paid for automatically only once it had been delivered to the consignee by the forwarder and the correct address had been verified via GPS. With a blockchain, smart contracts could assert independent contractual rights without requiring an intermediate authority. Providing a platform that is both trustworthy and transparent to all parties, the blockchain is consequently the medium needed to leverage the breakthrough of smart contracts. For the Internet of Things (IoT), the blockchain is the network required to enable devices to exchange payments and services through smart contracts. Work is already under way to bring this about, too.

Smart contracts are also of interest to the insurance industry, as blockchains could define terms of insurance and rules that would be executed automatically when certain conditions are met. A smart contract can be written if a reliable data source for natural catastrophe covers is available and could be used to trigger a parametric insurance. This is the basic idea underlying automated crop insurance covers. It indemnifies the farmer for crop failures as soon as a drought is confirmed by weather data. The associated contract and the weather data can be inspected and verified by all parties. IoT sensor measurements are saved in the blockchain and used by smart contracts to calculate subsequent payments.

Prototypes of an experimental cover for flight delays already exist. If passengers are interested in such insurance, they can pay the predefined premium into a smart contract. If the flight is delayed, the smart contract triggers a payment to the passenger following analysis of the arrival times. Underwriting and claims handling are fully automated in this case, as the claim can be pinned to a clear trigger. This model can be supplemented by adding a function allowing potential investors to contribute capital to cover a loss event. In return, the investor receives the premium if the flight lands on schedule.

Blockchains could also make the claims handling process more efficient for insurance companies. Claims reported via an app, for example, could be unequivocally documented in the blockchain. All further stages in the claims handling process would be securely documented in the blockchain in a manner transparent to both the client and the insurer. The usual correspondence exchanged between external loss adjusters, the insurance company and other parties would be eliminated, thus making claims management more efficient. In the healthcare sector, a private blockchain could be used to save and manage patient data securely without risk of manipulation or unauthorised access, and allow such information to be exchanged between various authorised users such as doctors, hospitals and health insurers.

Conclusion

Regardless of bitcoin’s future, blockchain technology looks likely to evolve in its own right. Almost a billion US dollars in risk capital has already been invested in the technology over the last few years. We can certainly expect more than one blockchain to emerge. Above all, we need alternatives to the bitcoin blockchain: alternatives that guarantee tamper-proof accounting but require less computational effort and hence less energy input to do so.

Public blockchains and closed blockchains, i.e. those managed by the private sector, will probably exist side by side. The latter would run somewhat counter to the original idea of a decentralised structure. Banks, for instance, would be interested in managing some of their services through their own blockchain.

It is still early days for the blockchain and, in the absence of an efficient infrastructure, it is hard to predict how things will develop. A new software architecture would be needed for this technology to work on a broad basis, but what costs this might entail is anyone’s guess. Despite this, the technology has already spawned its own – albeit still small – economic sector comprising a whole range of service providers. It would therefore be wise to take a serious look at the matter now to avoid being caught off guard later, should a revolution in the financial system take place. For insurers, however, this is an opportunity to develop new blockchain-based products which, by virtue of their transparency and greater efficiency, will be able to reflect new risks and markets.

来源:慕尼黑再保险公众号